pension

masterclass

a guide to living out your old age in style

produced by...

important!

For the best experience, complete the guide on your laptop/desktop - check your inbox for a link 👍

All of the information contained within this guide has been fact-checked by a Chartered Financial Planner but this doesn't mean it's financial advice! It's to be used for educational purposes only. For advice on your own circumstances, speak to an independent financial advisor.

What is a pension?

You get free money! AND YOU GET FREE MONEY!

So what exactly is a pension? A pension is just a savings pot which lets you put money away for your future self, all whilst getting big tax breaks (basically free money) from the government.

Any money you make on your pension investments is also tax free a bit like an ISA. Once it’s in your pension pot, your money is locked away until you’re 55 (57 from 2028), when you can use it as an income to live on. Your 70 year old self will thank you big time.

In this masterclass, we're talking about 'Defined Contribution' pensions. This is the more common type. It's where your pension pot is put into various types of investment, such as stocks and shares. Most company pension schemes are now defined contribution.

Why do I need one?

Things are looking up when it comes to our life expectancy 🎉 but this could mean many of us will be spending as long in retirement as we spend in work.

If you want a half-decent lifestyle, you need to get saving. Like, now! Research suggests that for a basic retirement you need £11k a year (assuming you’re mortgage free). But if you also want to enjoy life, eat out, have a couple of fun holidays, you’ll need £26k a year. That means saving £374k in your pension pot¹. I KNOW! The average UK pension pot is only worth around £50k – this is the pension gap, and it’s scary AF.

THE SCARY TRUTH 👻

So what does this mean for you now? If you’re aged 25 and you earn £28k a year, you’d need to save £350 a month (15% of your salary) to hit that target². And that’s assuming you’ll also get the full State Pension. A lot of people think they’ll be able to rely on this alone but, at less than £9k a year, it’s not going to cut it, and there’s no guarantee it will even exist by the time you retire! It's scary but you can do something about it.

¹Source: HL Pensions calculator & www.which.co.uk/money/pensions-and-retirement/starting-to-plan-your-retirement/how-much-will-you-need-to-retire-atu0z9k0lw3p

²Assumptions:

-

your employer pays in 3%

-

you retire at 68

-

you take out a 25% tax-free lump sum to spend (a pension perk)

-

you qualify for the full State Pension

-

investment growth is 5% a year and inflation 3%

What if I’m self-employed?

More of us than ever are self-employed and if that's you, then it’s even more important to sort your own pension as you’re not getting employer contributions.

Only 1 in 4 self-employed people are paying into a pension!

Freelancers often find their income fluctuates, but that shouldn't stop you. You can pay lump sums into a pension as and when you like (although FYI, once the money’s in, you can’t withdraw it again).

If you have a limited company, you can pay into a pension through it to reduce your corporation tax bill. Sneaky 🎉

If you're self-employed, you should look at setting up a

personal pension

When should I start one?

ASAP!

You’re never too young to start (did you know pensions for kids are a thing?).

🔮the MAGIC OF COMPOUNDING 🧙🏼♀️

Starting now means you have more time to make the most of the closest thing to magic that personal finance has to offer: compound interest.

Compound interest is when your money earns interest and then you also earn interest on the interest. I know. Wow.

Confused? Imagine a snowball rolling downhill: the returns mount up as they are reinvested and your money multiplies impressively over time.

It looks like this:

IF YOU STARTED WITH £100

AND YOUR INVESTMENTS GREW

BY 8% A YEAR

What are the different pension types?

Most people will have what’s called a ‘defined contribution’ (DC) pension, which just means the size of your pension pot when you retire will be defined by how much you paid in over your working life (and how your investments performed.)

There are two types, workplace pensions or personal pensions:

WORKPLACE PENSIONS

WHAT are they?

💼Also called a company pension or occupational pension

💰It's run by your employer

✅You are automatically opted in unless you choose to opt out (if you’re aged 22+ and earning over £10k a year)

❓ Aged between 16 and 21? Your employer won't automatically enrol you in their workplace pension but you have the right to join and both you and your employer will both contribute.

🚨 But don’t opt-out or you’ll miss out, as your employer has to pay in too - FREE MONEY!

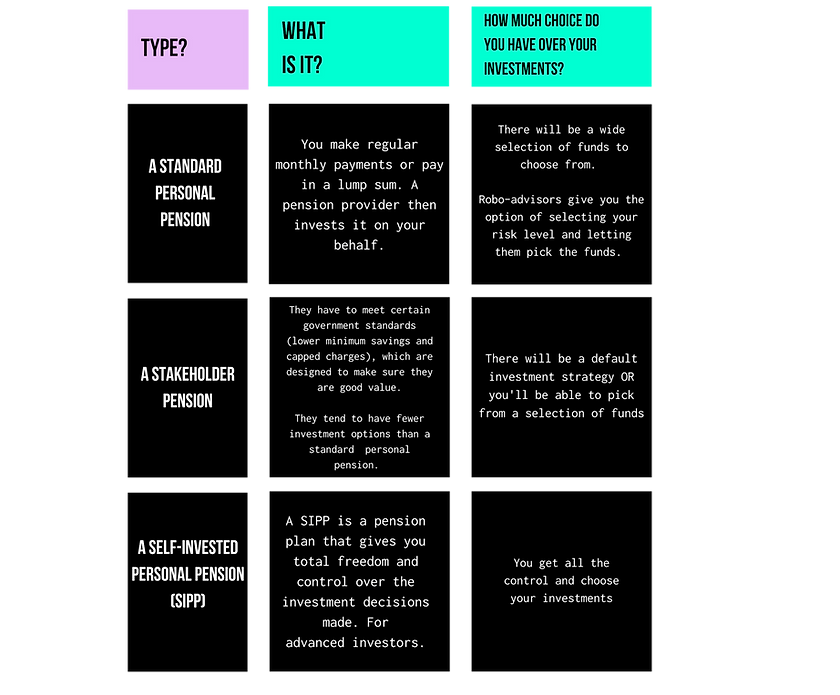

picking a personal pension

1. do you want to choose your investments?

NOPE

If you’re not confident in choosing your own investments, you might want to consider a standard personal pension or stakeholder pension.

There are many providers which offer readymade pension pots that you can just set and forget.

If you don't want to have anything to do with selecting funds, consider robo advisors. They'll get you to complete a quick quiz to assess your risk level, and take care of the rest for you.

YES

If you do want to choose your own investments, SIPPs, Stakeholder or Standard pension providers will offer more choice. You then have a few things to think about

-

Active or Passive funds? - A lot of people start with passive funds because it’s a cheap and easy way to invest. Active funds are more expensive but there is a human being whose job it is to manage the fund.

-

Ethical investing? - you might have other priorities, such as wanting your money to make a difference. If so, you can hold ethical or socially responsible investments in your pension.

2: research providers

Based on the type of pension you've selected, use 'BEST BUY' tables to do a bit of research into providers.

Questions to ask:

🧐 How is my money invested?

🧐 Do they have an app?

🧐 Is their website/app user-friendly?

🧐 What are the fees?

🧐 Do they have an ethical investing option?

🧐 What do other people say? (Check out TrustPilot for reviews)

🚨 a word on charges 🚨

Charges are important because they can eat away at your returns, so check you understand what they are before committing and know what you're being charged and when.

decide How much you want to pay in

How much? As much as possible! If you can afford to, make sure you're contributing at least the maximum amount that your employer will match.

But FIRST:

✅ Deal with any debt

✅ Build a cash emergency fund.

You can usually start small with a monthly savings plan of around £50 a month.

how much risk should i take?

When you review your workplace pension or open a personal pension you'll be given the option to review or select how much risk you want to take.

This isn’t an easy question to answer as everyone's needs and willingness to take risks will be different.

If you're young...

..you can take more risk in things like stocks and shares because you have time on your side to ride out any bumps along the way (a.k.a recover from any investment losses). Just make sure you're cool with the amount of risk you're taking 👍.

personal pension

checklist

Check you’re not already in a workplace pension scheme.

Do some research to find a personal pension provider you like the look of – check out Best Buy tables.

Ask: Is it user friendly? Digital or old school? What’s the cost? A good investment choice? Will you DIY or buy a ready-made portfolio?

workplace pension

checklist

Make sure you’re signed up to your company’s scheme.

Request a pension review with the scheme provider.

Check you’re happy with your investments, risk level and performance.

Are your monthly payments as high as you can afford? Have you maxed out what you can get from your company and from the government in tax relief?

Does your company match your pension contributions? If so, make the most of it!

_pn.png)